How to Repay Your Zype Loan?

Table of Contents

ToggleWhat is a Zype loan?

Zype loan is the fastest way to fund all your big and small expenses. Whether you’re caught in a medical emergency or are planning to buy your 1st two-wheeler, an instant personal loan from Zype can make sure you never fall short.

Here’s how you can get an instant access to a personal loan of up to Rs. 5 lakhs from Zype:

Complete your application in less than 6 minutes with no documents or paperwork.

Get approved for a personal loan in less than 60 seconds.

Get instant disbursal directly into your registered bank account.

What Are the Options to Repay Loan on Zype?

What matters most when borrowing money isn’t just flexibility, but rather, how you go about repaying it. Keeping this in mind, Zype ensures that the convenience of borrowing goes beyond receiving the money in your account. This way, you will never feel any kind of financial strain.

Wondering how to repay loan on Zype? Here are some quick, easy and flexible options.

Create a Budget

The first and most important step when going about your loan EMI repayment is creating a budget for it. Taking into account your income and all your expenses and make sure you make your loan repayment a part of it.

Make Part-Prepayments Whenever You Can

One of the best parts about making your EMI payments on Zype is that there are no prepayment charges! If you have extra funds and want to clear your outstanding, all you need to do is open the app to make the payment.

Reduce the Tenure And Opt for Higher EMIs

With multiple EMI options of 6, 9 or 12 months, you can have a flexible loan EMI repayment experience on Zype. If you want to clear your outstanding loan immediately, you can choose an EMI option of 3 months.

Prioritise High-Interest Loans

Clearing your high-interest loans first can lighten the financial burden, helping you repay your loans as soon as possible.

Automatic Payments

One of the easiest ways of ensuring you don’t miss your EMI payments is by setting up an auto-debit. Zype allows this facility where you just need to set your auto-debit for loan repayments once and forget about it! The EMI amount will automatically get deducted from your registered bank account.

Avoid New Debt

An important step when planning your finances is planning your loans and its repayments. Make sure you avoid any kind of new debt when you have an ongoing repayment.

Consider A Side Hustle

Adding an extra source of income can help you speed up your loan repayment process. There are many part-time and freelance options available in the market that can help you open a new stream of income.

Stay Committed

When you’re figuring out how to repay loan, it’s important to remember that staying committed to your repayment plan can help you ensure you don’t miss any due date. This will help you build a strong credit profile and maintain a healthy credit profile.

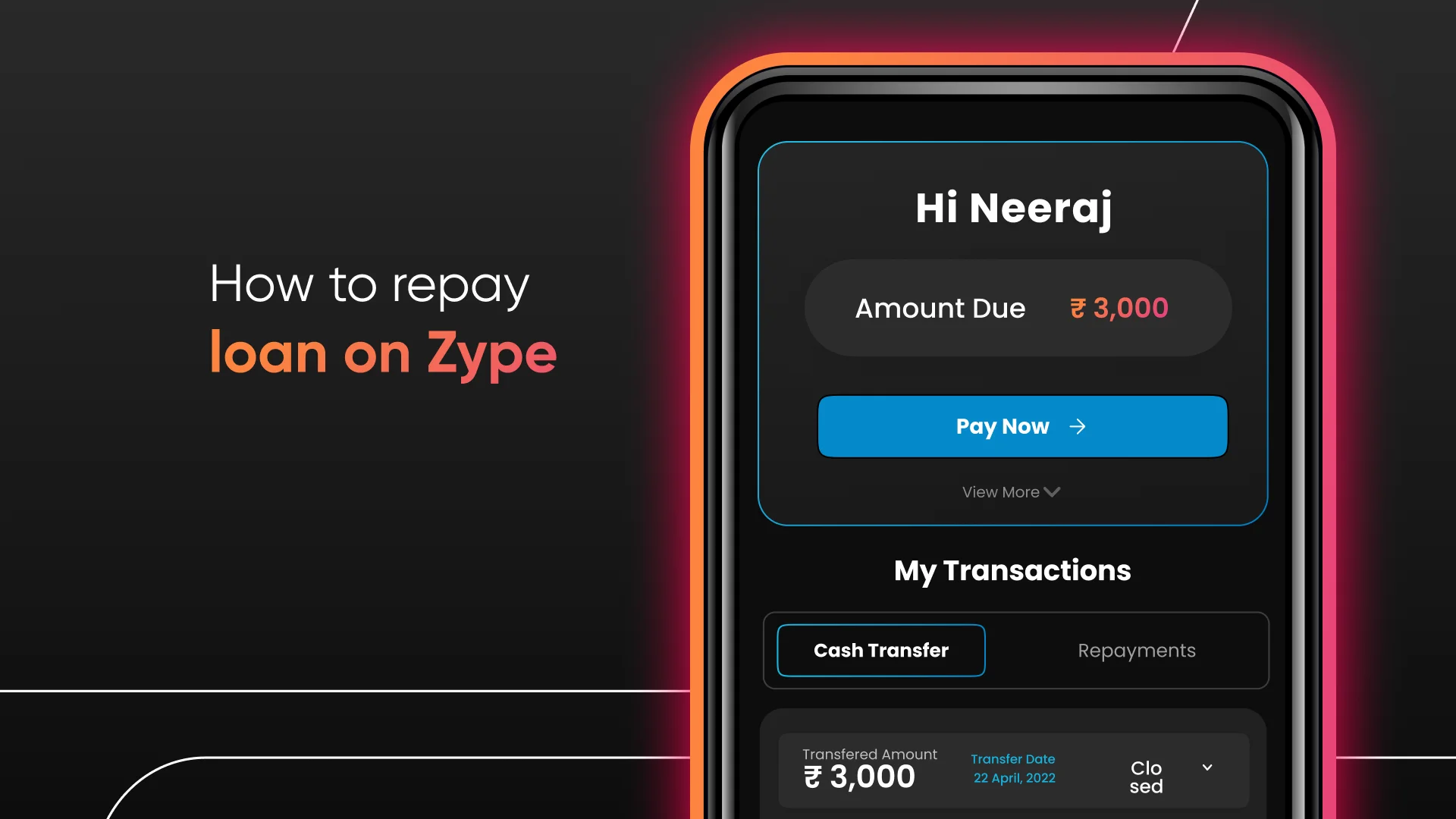

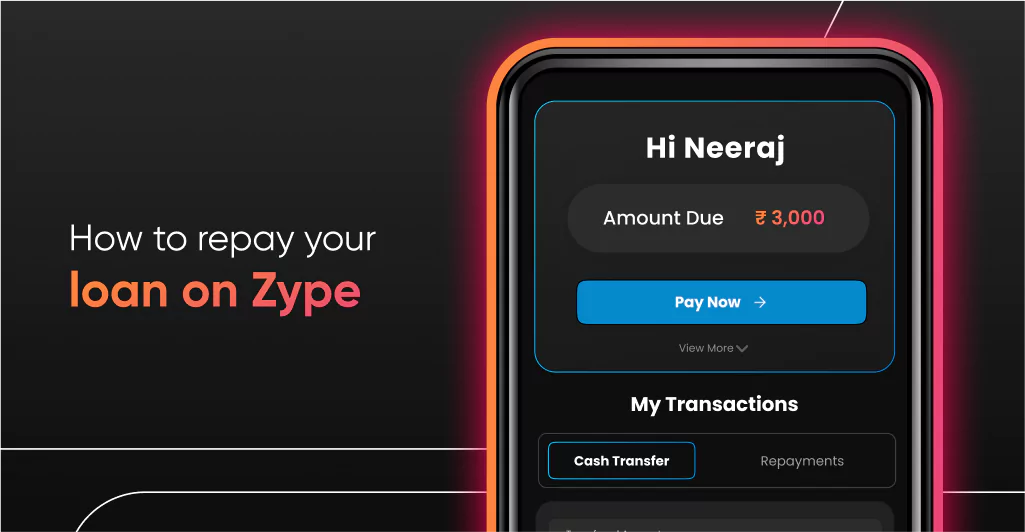

This blog aims to tell you the step-by-step process of repaying your Zype loan EMI.

- Open the app and tap on the ‘Account’ button at the bottom-right corner of the screen.

- On the next screen, you can see your due amount. Tap “Pay Now” to initiate repayment.

- Choose due amount or enter a custom personal loan to repay.

- Choose your preferred payment method from Debit card, UPI and Net banking to complete the repayment process.

- You’ll get the payment confirmation message once the payment is successful.

Benefits of Paying EMIs on Time

1) Get Higher Credit Limit on Zype

Paying your EMIs on time can increase your eligibility for a higher loan limit on Zype. This also helps to increase your credit score.

2) Improves Credit Score

Your timely EMI payments prove that you can manage your credit responsibly. Each timely repayment adds on to positive payment history and increases your credit score.

3) Avoid Penalty Charges

Lenders usually charge late payment fees if you don’t pay your EMI on the due date. Paying EMIs on time will help you avoid this extra cost.

Frequently Asked Questions

Yes, you can. On Zype, you can pay your loan conveniently in 6, 9 or 12 EMIs. If you have extra access to funds, you can also consider prepaying your loans as there are no prepayment charges on the same.

Yes, you can. Zype offers multiple EMI options of 6, 9 or 12 EMIs so you can repay loan on your terms.

Typically, lenders charge an extra fee known as prepayment charges when you pay more than your EMI. However on Zype, you can pay more than your EMI with absolutely no consequences.

When you have fully repaid your loan, you will be completely out of debt. You can consider taking another loan and make timely payments, which can help you improve your credit score.

On Zype, there are no penalties for early loan repayment.

You can use this simple formula to calculate your total loan repayment amount:

EMI = [p x r x (1+r)^n]/[(1+r)^n-1]

P is your principal amount

R is your interest rate

N is the tenure