Principal Amount

- 3000

- 5L

Total Interest Payable

- 6

- 38

Loan Term (in months)

- 3

- 72

Select Language :

A ₹10,000 personal loan is a small instant loan that helps you cover urgent or emergency expenses like medical bills, utility payments, or sudden travel. Offered by banks, NBFCs, and digital apps like Zype, this type of urgent loan ₹10,000 typically requires minimal documentation. You can get approval within minutes, and the loan disbursal is usually done within 24 hours.

Whether you’re looking for a personal loan ₹10,000 urgently for medical expenses or an emergency loan ₹10,000 loan is an apt option as it’s a quick and easy solution.

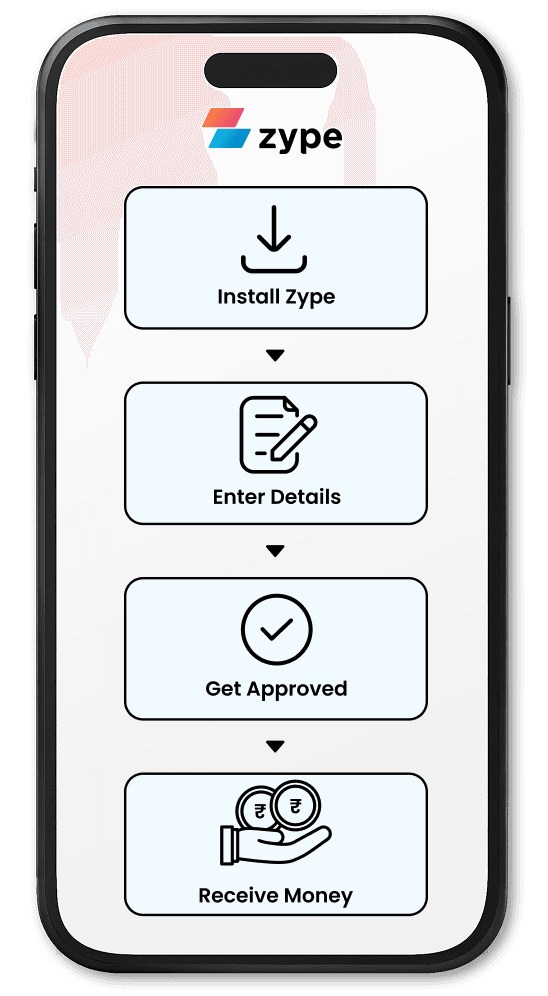

Need an urgent ₹10,000 loan? Zype offers a fast, 100% digital solution to manage unexpected expenses, bills, or planned purchases.

Whether it’s a 10000 loan for medical bills, travel, or rent, Zype ensures quick access to loan when you need it most. This is a great option for salaried individuals looking for a personal loan ₹10,000 urgent needs.

With Zype, convenience meets speed, making personal loans a pleasant experience for you. Here’s why you should consider taking your ₹10,000 personal loan from Zype:

Zype loans are unsecured loans. This means that you don’t have to provide any assets like gold, jewellery, shares, or any other assets to get instant cash loan for the money you need.

Repaying your Zype personal loan will never feel like a financial burden. With multiple repayment options of 6, 9, 12 or 18 EMIs you can choose a plan that fits your budget.

Completing your application on the Zype app is just a matter of a few taps. Just enter your basic details like name, phone number, email, PAN, etc. and complete your application in 6 minutes without any document upload or paperwork.

When the urgent need for cash comes knocking on your door, Zype is right here to help you out! Because with an approval time of 60 seconds and disbursal instantly, you will always get instant access to money.

The interest rate you’re offered on your personal loans depends on various factors like your repayment history, income, and credit score. Zype offers affordable interest rates on their personal loans starting at just 1.5% per month.

This is what your repayment tenure will look like when you take a ₹10,000 at an 18% annual interest rate. Calculating your EMI manually can be time-consuming and prone to human error. But there’s an easier option!

The best borrowing practice is to calculate your personal loan EMIs even before you start your application process. This can help you understand what your repayments will look like and choose a tenure that fits your budget. Calculate your EMI and compare offers across various lenders to get your hands on the best borrowing terms.

You can use this formula to calculate your EMI:

E = 10000 x R x (1+R) ^N / [(1+R)^N-1], where

E is your personal loan EMI amount

R is the monthly interest rate

N is the no. of months of EMI payment

But there’s a better way to do this! Keep reading to find out.

A personal loan should serve as a financial lifeline and never feel like a burden. This is exactly why it’s important to select a personal loan repayment plan that’s flexible and fits your budget. On Zype, you can do that by choosing a repayment plan of 6, 9, 12 or 18 EMIs.

This is what your repayment tenure will look like when you take a ₹10,000 at an 18% annual interest rate.

| Loan Amount (₹) | Interest Rate (%) | Tenure (in months) | EMI (₹) |

|---|---|---|---|

| 10,000 | 18 | 6 | 1,755.25 |

| 10,000 | 18 | 9 | 1,196.10 |

| 10,000 | 18 | 12 | 916.80 |

| 10,000 | 18 | 18 | 638.06 |

Note: The above table is just for illustration purposes. The actual number may differ.

Amortization is the process of paying off a loan through regular, fixed payments over time, covering both the principal and interest. Let’s take a look on example:

| Payment Month | EMI (Interest + Principal) | Interest | Principal | Balance |

|---|---|---|---|---|

| 1st | ₹1755.25 | ₹150.00 | ₹1605.25 | ₹8394.75 |

| 2nd | ₹1755.25 | ₹125.92 | ₹1629.33 | ₹6765.42 |

| 3rd | ₹1755.25 | ₹101.48 | ₹1653.77 | ₹5111.65 |

| 4th | ₹1755.25 | ₹76.67 | ₹1678.58 | ₹3433.07 |

| 5th | ₹1755.25 | ₹51.50 | ₹1703.76 | ₹1729.31 |

| 6th | ₹1755.25 | ₹25.94 | ₹1729.31 | ₹0.00 |

* The above table is only for illustration purpose

The table effectively shows how the loan balance decreases with each payment, which is the essence of amortization.

There are some charges associated with borrowing money. This includes interest rates and processing fees.

Zype’s terms of borrowing are simple and transparent! Here’s the complete information you need to know about your loan terms.

| Fees & Charges | Amount Chargeable |

|---|---|

| Interest Rate | Starting at as low as 1.5% (monthly) |

| Loan Processing Charges | Processing fees from 2% to 6% on every loan |

| Interest on Overdue EMIs | Late payment penalty charges & overdue interest will be charged to your total outstanding loan on a daily basis |

One of the best parts about taking a personal loan from Zype is that you can complete your application without any document upload or paperwork. This is all you need to know about required documents to apply for the loan:

You will require your PAN and Aadhaar number to complete your loan application and KYC process. (Physical copies not required)

After you have completed your application and are approved for a loan offer, you will need to complete a real time selfie verification and Aadhaar linked mobile OTP to unlock the loan.

If you want to apply for a higher loan limit, all you need to do is submit your bank statement for the last 4 months and get an increased offer.

You can get an approved loan offer from Zype by completing a few simple steps. Before applying for the loan limit, check these eligibility criteria to see if you’re eligible for the loan.

21 years or above

Valid PAN & Aadhaar card

Salaried individual

Monthly income of at least ₹15,000

Instant personal loans of ₹10,000 can help cover various immediate financial needs. Here are some common purposes:

To cover urgent medical expenses, including doctor consultations, medicines, or diagnostic tests.

To manage last-minute costs like attire, decorations, or gifts for the special day.

For buying books, paying course fees, or attending a short-term workshop or class.

To cover unexpected travel costs, such as ticket bookings, accommodation, or trip add-ons.

To purchase or upgrade gadgets like smartphones, headphones, or smartwatches.

For small repairs, painting, or enhancing home interiors without delay.

This type of loan offers quick access to funds, making it a convenient solution for short-term needs.

If you need a ₹10,000 rupees loan urgently”, you can apply online in just a few steps and get instant approval. The process is fully digital with minimal paperwork, flexible EMIs, and quick disbursal.

For a ₹10,000 personal loan, you will generally need a CIBIL score of 650 or higher. Few lenders may approve loans with slightly lower scores, but this also results in higher interest rates or stricter loan terms.

Yes, you can get a ₹10,000 loan urgently through online lenders, NBFCs. With Zype, you get loan with quick approval and disbursal within minutes, once loan gets approved.

Yes, you can get a personal loan even with a ₹10,000 salary, with Zype. Loan approval depends on your overall profile, and the loan amount is adjusted accordingly.

You can get a ₹10,000 loan instantly on Zype with just your PAN and Aadhaar. No heavy paperwork nor long waits required. The process is 100% digital, and funds are disbursed within minutes after approval.

Yes, ₹10,000 is considered a small personal loan. It is perfect for urgent expenses like medical bills or utility payments. With Zype, you can get a small loan instantly with few steps.

Yes, taking a ₹10,000 loan from Zype is safe. Zype is a trusted, RBI-compliant platform with transparent terms, instant support and no hidden charges. Just ensure your KYC is complete and borrow only what you need.

Yes, with Zype, you can get an instant ₹10,000 loan even without a salary slip. Just upload your bank statement or use other basic income proof for quick approval.

For a ₹10,000 personal loan on Zype, your monthly EMI is based on your chosen tenure and applicable interest rate. Use Zype’s in-app EMI calculator to get an estimate.

To get a ₹10,000 personal loan from Zype, you must be a salaried employee with a valid PAN and Aadhaar card. Check our eligibility criteria for exact terms.

With Zype, your ₹10,000 personal loan is approved instantly, and the amount is usually credited to your bank account within 24 hours. No paperwork or branch visits required.

If you default on a ₹10,000 personal loan, it can lower your credit score and attract penalties or legal action. Due to defaults, you may also reduce your chances of getting loans in the future.

You can get a ₹10,000 personal loan without collateral by applying online on platforms like Zype using just your PAN and Aadhaar card. Once the eligibility criteria are fulfilled, the loan is approved instantly and disbursed within minutes.

On Zype, for a ₹10,000 loan, you just need to upload your PAN, Aadhaar, and income proof digitally on the app or website.

To get a ₹10,000 loan without a CIBIL score, just download the Zype app, complete basic income details and complete e-KYC. Get instant approval and choose your loan amount and repayment tenure easily.

Select the loan details you want to know

Copyright © 2025 Easy Platform Services Pvt Ltd. All rights reserved.