Principal Amount

- 3000

- 5L

Total Interest Payable

- 6

- 38

Loan Term (in months)

- 3

- 72

Select Language :

Need 50000 rupees loan urgently? Get a quick personal loan of 50,000 with a fast and hassle-free process. Whether it’s for an emergency or unexpected expenses, secure your funds instantly with minimal paperwork. Enjoy flexible EMI options and competitive 50,000 personal loan interest rates starting at just 1.5% per month. 50,000 urgent loan? Apply now and get fast approval in a few minutes!

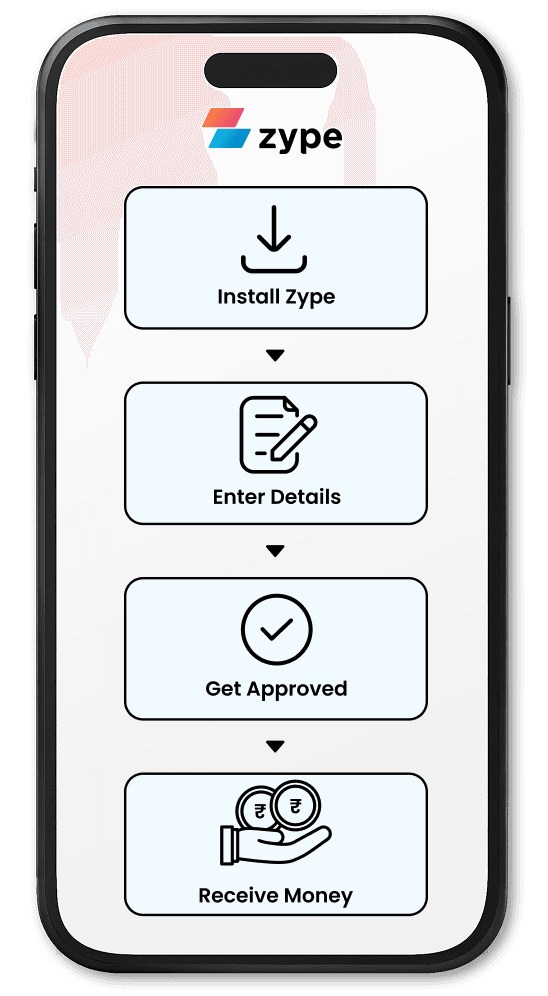

Apply for an instant ₹ 50,000 loan in less than 6 minutes, get approved within 60 seconds & have the money in your account instantly. Borrow the money you need now & pay later in flexible 6, 9, 12 or 18 EMIs.

A super-fast ₹50000 loan is not all that you get. Here are some more reasons to choose a Zype personal loan

it's personal loans are unsecured. This means you can enjoy the flexibility of borrowing without pledging any of your assets.

Get an affordable interest rate on your personal loans that starts at as low as 1.5% interest per month.

Choose a repayment plan without worrying about your finances. Borrow the money you need now & pay later in 6, 9, 12 or 18 EMIs.

After you complete your application, you can get approved for a loan in less than 60 seconds and get the money in your account instantly!

Get a loan without any document uploads or paperwork. All you need to submit is your PAN & Aadhaar number along with some basic details to complete your application.

Calculating the Personal Loan EMIs before you take a personal loan can help you plan your budget better & even compare offers across various lenders.

Here’s the formula used to calculate EMIs for your ₹50000 loan

E = 50000 x R x (1+R)^N / [(1+R)^N-1], where

E is your personal loan EMI amount

R is the monthly interest rate

N is the no. of months of EMI payment

You can either use this formula or quickly find out your EMIs using Zype’s personal loan EMI calculator.

With us, the flexibility of borrowing money doesn’t end after you receive the money in your bank account.

It’s convenient repayment options help you choose a plan that will best suit your budget so you can manage your finances comfortably. Borrow the money you need now and choose to repay in 6, 9, 12 or 18 EMIs.

This is what your repayment tenure will look like when you take an instant ₹50000 loan at an 18% annual interest rate.

| Loan Amount (₹) | Interest Rate (%) | Tenure (in months) | EMI (₹) |

|---|---|---|---|

| 50,000 | 18 | 6 | 8,776.26 |

| 50,000 | 18 | 9 | 5,980.49 |

| 50,000 | 18 | 12 | 4,584.00 |

| 50,000 | 18 | 18 | 3,190.29 |

Note: The above table is just for illustration purposes. The actual number may differ.

| Fees & Charges | Amount Chargeable |

|---|---|

| Interest Rate | Starting at 1.5% (monthly) |

| Loan Processing Charges | Processing fees from 2% to 6% on every loan |

| Penalty on Overdue EMIs | Late payment penalty charges & overdue interest will be charged to your total outstanding loan on a daily basis |

You can get approved for a ₹50000 personal loan by meeting Zype’s basic eligibility criteria

21 years and above

Valid PAN & Aadhaar card

Salaried individual

Monthly income of at least ₹15,000

You can complete your loan application without any document uploads or paperwork & get an emergency loan of ₹50000. You only need these required documents to get approved for a loan.

After you’re approved for a loan, you will need to do a real-time selfie verification to complete your KYC.

Enter your PAN & Aadhaar number along with a few basic details to complete your application & activate your loan (Physical documents not required)

Want to increase your loan limit? All you need to do is upload your bank statement for the last 4 months & get approved for a higher amount.

A ₹50,000 personal loan can be utilized for multiple purposes. A personal loan gives you the financial freedom to address your immediate requirements. Here are some common uses:

A personal loan is the ideal alternative for covering any unexpected emergency demands, particularly medical and hospital fees.

A ₹50000 Personal Loan is ideal for home improvement expenses like repairs and renovation

Help finance wedding costs, from venue bookings to catering and decorations.

Pay for tuition fees, books, or other educational expenses

Combine multiple debts into one loan, simplifying repayments and potentially reducing interest rates.

Fund a last-minute trip or vacation to recharge and relax.

Create a safety net for unplanned expenses, ensuring you’re prepared for any situation.Fund a last-minute trip or vacation to recharge and relax.

A ₹50,000 personal loan offers flexibility to help manage finances and achieve goals quickly.

If you need a ₹50,000 rupees loan urgently”, you can apply online in just a few steps and get instant approval. The process is fully digital with minimal paperwork, flexible EMIs, and quick disbursal.

Yes, you can! There are many instant loan apps that offer loans without any documentation. Zype is an app where all you need is your PAN & Aadhaar number to get approved for a personal loan.

Yes, you may get approved for an online loan of ₹50000 with a credit score of 650 depending upon the lender.

Your personal loan EMIs depend on your approved loan amount, interest rate on loan & selected loan tenure.

Yes, you can get a ₹50,000 loan urgently through instant personal loan apps like Zype or NBFCs with minimal documentation. Approval and disbursal often happen same day.

If you have a good credit score & repayment history, you can get approved for a personal loan at the lowest interest rate. Zype offers loans that start just at 1.5% interest (monthly)

If you need a ₹50,000 loan urgently, you can apply online through Zype very quickly for 50,000 loan! Complete your application in less than 6 minutes, get an approved offer within 60 seconds & get the money in your account on the same day.

Most lenders prefer a credit score of 650 or above, but some financial institutions offer 50,000 loans to individuals with lower scores based on their income and repayment ability. If your score is low, you may get a higher interest rate or need a guarantor.

A ₹50k loan is relatively easy to obtain if you meet the lender’s criteria. Many digital lenders offer instant approval with minimal documentation, making the process quick and hassle-free. Having a steady income and good repayment history improves your chances.

Select the loan details you want to know

Copyright © 2025 Easy Platform Services Pvt Ltd. All rights reserved.