Principal Amount

- 3000

- 5L

Total Interest Payable

- 6

- 38

Loan Term (in months)

- 3

- 72

Select Language :

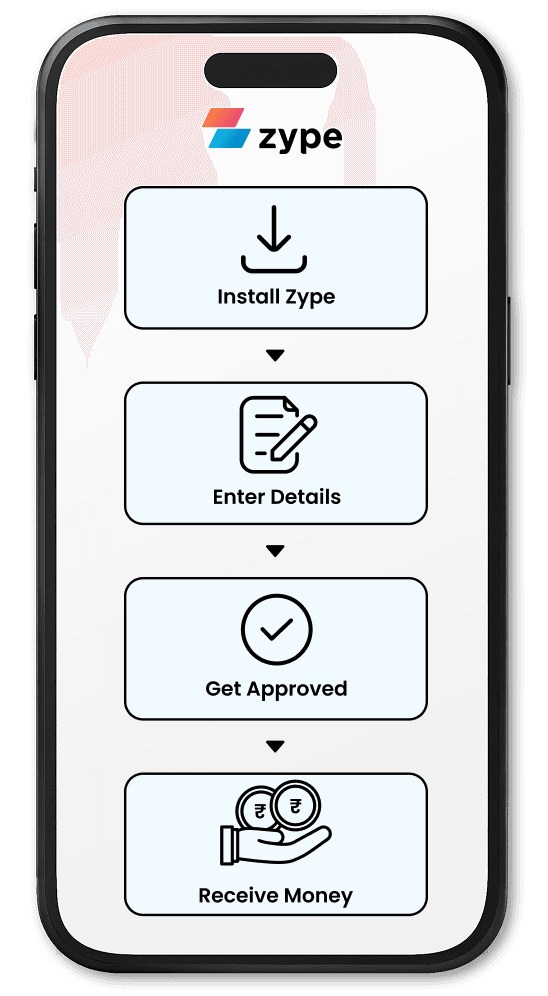

Need ₹20,000 loan urgently? Zype is here to help! Whether it’s for a medical expense, utility bill, or unexpected shopping, Zype makes getting a ₹20,000 emergency loan quick and stress-free. Get instant approval in just 6 minutes and receive funds in your account within 60 seconds

With our platform, you can benefit from competitive interest rates starting at 1.5% per month, flexible repayment options of 6, 9, 12 or 18 months, and instant disbursal in just 60 seconds. This ensures you have access to funds exactly when you need them, without the stress of lengthy approval processes.

It can’t get any better than us when you need a ₹20000 personal loan fast and with utmost ease.

Our automated platform ensures fast approvals.

Benefit from affordable interest tailored to your credit profile.

No security deposit or collateral required.

Manage your budget better by choosing convenient EMI durations.

Receive your money in your account the same day.

It is a healthy financial habit to know the EMI amount you would need to pay before availing a loan. This helps you to choose the loan amount and EMI tenure that aligns with your budget.

Use this formula to calculate the EMI amount for different loan tenures and select your repayment plan accordingly –

E = P x R x (1+R)^N / [(1+R)^N-1], where

E is your personal loan EMI amount

P is the amount you are borrowing from the loan provider

R is the monthly interest rate

N is the no. of months of EMI payment

You can also use our loan EMI calculator and select a plan that fits your budget.

Want to plan your loan better before applying? Our EMI Calculator makes it easy. Just enter a few details, and you’ll know exactly what your monthly EMI will look like. It helps you stay in control of your budget and make smarter borrowing decisions.

Here’s how to use it:

With Zype, enjoy the convenience of choosing the repayment tenures of 6, 9, 12 or 18 months and manage your budget with ease.

You can also use it’s intuitive loan EMI calculator to check the monthly instalment amount of ₹20000 personal loan.

Check out the sample breakdown of estimated EMI amount on an instant 20000 loan without documents

| Loan Amount (₹) | Interest Rate (%) | Tenure (in months) | EMI (₹) |

|---|---|---|---|

| 20,000 | 18 | 6 | 3,510.50 |

| 20,000 | 18 | 9 | 2,392.20 |

| 20,000 | 18 | 12 | 1,833.60 |

| 20,000 | 18 | 18 | 1,276.12 |

Note: The above table is just for illustration purposes. The actual number may differ.

The cost of borrowing money is the interest payable on the loan. We provides tailored interest rates for every user based on their credit profile. If you have a good credit repayment history and a high credit score, you will get loans at lower interest rates.

Our loans are very affordable. You also get full disclosure of loan terms and there are no hidden charges.

| Fees & Charges | Amount Chargeable |

|---|---|

| Interest Rate | Starting at as low as 1.5% (monthly) |

| Loan Processing Charges | Processing fees from 2% to 6% on every loan |

| Interest on Overdue EMIs | Late payment penalty charges & overdue interest will be charged to your total outstanding loan on a daily basis |

Have a look at these simple eligibility criteria to check if you can get an urgent loan of ₹20000 from us and download the app to complete the application process to get your loan limit.

21 years or above

Valid PAN & Aadhaar card

Salaried individual

Monthly income of at least ₹15,000

We gives an instant 20000 loan without document upload or paperwork. To get personal loans from us, simply enter the information mentioned below –

To complete this step, all you need to do is a selfie-based verification after you’ve got your loan limit.

You will only need to enter your PAN & Aadhaar number to get a loan limit and complete your KYC. The process does not involve any document upload or physical paperwork.

In case you are not satisfied with your loan amount and want to upgrade the same, you can upload the bank statement of the last four months of your bank account where you receive your salary.

A ₹20,000 personal loan from us can be a versatile financial tool, catering to various needs and helping you manage your expenses effectively. Here are some common purposes for which you might use this loan:

Cover flight tickets, hotel stays, and sightseeing for your domestic or international trip.

Fund basic repairs or small renovations to enhance your living space.

Manage key wedding costs like venue, catering, or outfits stress-free.

Handle hospital bills, medicines, and urgent treatments with ease.

Pay your rental deposit and relocation expenses without worry.

Buy the latest model or upgrade your current device with zero hassle.

Purchase essentials like a fridge, washing machine, or AC to make home life smoother.

If you need a ₹20,000 rupees loan urgently”, you can apply online in just a few steps and get instant approval. The process is fully digital with minimal paperwork, flexible EMIs, and quick disbursal.

Yes, you can get an instant personal loan of ₹20,000 Without a CIBIL Score on your Aadhaar card and PAN if you meet the lender’s eligibility criteria. Many instant personal loan apps offer loans online, ensuring you get funds quickly.

Yes, you can avail a ₹20,000 Loan Without Documents by applying for a small loan online with just your Aadhaar and PAN details. Some instant personal loan apps like Zype offer quick loans online without the hassle of uploading multiple documents.

Lenders may require a minimum monthly income of ₹15,000–₹20,000 for a personal loan in 24 hrs. To check eligibility,you can choose any personal loan app like Zype, download it from the playstore and apply for a loan in just 6 minutes.

Yes, you can get ₹20,000 Personal Loan Without Collateral with personal loan apps like Zype. These simple loans are unsecured, making them easier and faster to process.

Yes, you can get a ₹20,000 loan urgently on Zype by just completing the eligibility criteria and submitting basic documents like PAN and Aadhaar for instant approval.

The EMI for ₹20,000 personal cash loans depends on factors like :

Using a 5-min loan app with an EMI calculator helps you choose the best repayment plan.

Yes, to get the lowest interest rate on a ₹20,000 personal loan, online loan apps like Zype start at just 1.5% per month. To secure an instant Aadhar loan with low interest, maintain a good credit profile and timely repayment history.

Repayment tenure for a ₹20,000 personal loan online usually ranges from 6 months to 12 months. Choose a tenure that balances affordability and total interest costs.

To choose your EMI Plan for a ₹20,000 personal loan, use an easy cash loan online app’s EMI calculator to decide the best plan. Enter the loan amount, tenure, and interest rate to find a suitable EMI. Adjust tenure to balance EMI size and total repayment.

Yes, you can avail a personal loan of ₹20,000 using your PAN card, provided you meet the lender’s eligibility criteria. Many financial institutions offer instant loans under PAN card-based verification, requiring minimal documentation.

Select the loan details you want to know

Copyright © 2025 Easy Platform Services Pvt Ltd. All rights reserved.